does oklahoma have an estate or inheritance tax

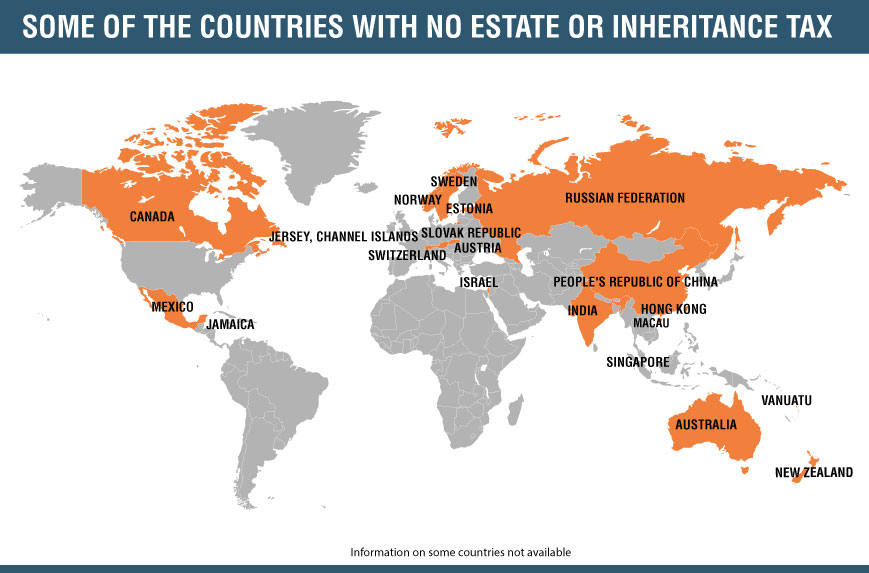

May 02 2022. In addition to the federal estate tax with a top rate of 40 percent some states levy an additional estate or inheritance tax.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

The state does have a gas tax along with sin taxes on cigarettes and alcohol but these are relatively low.

. Maryland is the only state to impose both. The tax burden that your estate has is another factor that could prolong the probate. If the estate has real estate in multiple states you may have to go through separate probate processes which may or may not delay the distribution of assets.

Marylandwhich also has an estate taximposes the lowest top rate at 10 percent. Impose estate taxes and six impose inheritance taxes. May 02 2022 4 min read.

Find out if your loved ones. Many states repealed their estate taxes as a result. A majority of US.

2010 in Kansas and Oklahoma. This is particularly true if you have to deal with estate taxes. The only tax thats steeper in Oklahoma than in the rest of the country is the sales tax.

Beneficiaries and heirs will pay any federal or state impose inheritance tax once their inheritance is disbursed. Unlike an estate tax beneficiaries pay the inheritance tax and it is. The Ohio estate tax was repealed as of January 1 2013 under Ohio budget laws.

Compare state estate tax rates and state inheritance tax rates below. Since a transfer on death account is not a trust it is part of the decedents estate. The federal estate tax return offered a credit toward state-level estate taxes and states based their own tax rates on this federal credit.

New Jersey phased out its estate tax in 2018. How to File a Small Estate Affidavit in California Californias small estate affidavit procedure provides an easy way to inherit property. During this time the executor will also file the final tax return for the estate and pay any taxes owed.

And should you be concerned about the implications of either on your estate plan. How an Estate Tax Works. Learn the specific estate planning documents you need to protect yourself and your loved ones.

It does not avoid or minimize estate taxes. And should you be concerned about the implications of either on your estate plan. Of the six states with inheritance taxes Nebraska has the highest top rate at 18 percent.

All six states exempt spouses and some fully or partially exempt immediate relatives. States wont collect a death tax at the state level. But that changed in 2001 when federal tax law amendments eliminated the credit.

And sales taxes there are no taxes in Oklahoma that will significantly affect the budgets of most seniors. At one point all states had an estate tax. It has no estate or inheritance tax.

Get a list of states without an estate or inheritance tax. Whats the difference between an estate tax and an inheritance tax. Most states have been moving away from estate or inheritance taxes or have raised their exemption levels as.

Whats the difference between an estate tax and an inheritance tax. Twelve states and Washington DC. Get a list of states without an estate or inheritance tax.

An inheritance tax is a state-imposed tax that you pay when receiving money or property from a deceased persons estate. This includes federal and state income taxes as well as any federal estate taxes and state estate taxes.

We Buy Houses Oklahoma Close In 7 Days Any Condition Fast Ca H Easy Sell

Countries With Or Without An Estate Or Inheritance Tax Policy And Taxation Group

Oklahoma Estate Tax Everything You Need To Know Smartasset

Sell Inherited Home Fast For Cash Distressed Property Selling Your House We Buy Houses

Do I Need To Pay Inheritance Taxes Postic Bates P C

Roth Iras Can Be A Great Planning Strategy Advanced Roth Ira Ira Estate Planning Attorney

Here S Which States Collect Zero Estate Or Inheritance Taxes

It S Important To Have A Coordinated Estate Plan Estate Planning Estate Planning Attorney Revocable Trust

Oklahoma Estate Tax Everything You Need To Know Smartasset

Oklahoma Estate Tax Everything You Need To Know Smartasset

Do I Need To Pay Inheritance Taxes Postic Bates P C

These 10 Towns In Wyoming Have The Best Main Streets For Exploring Wyoming Travel Wyoming Wyoming Travel Road Trips

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

The Strong Willed Child Parenting Strong Willed Child Strong Willed Child Parenting

Sell Your House North Carolina Selling House Sell House Fast Sell Your House Fast

How Do State Estate And Inheritance Taxes Work Tax Policy Center

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Countries With Or Without An Estate Or Inheritance Tax Policy And Taxation Group

States With No Estate Tax Or Inheritance Tax Plan Where You Die